IPP / Chemical / Mining / Infrastructure

Placement

An insurance policy is only a piece of paper if the claim is not paid. From this perspective, it is of pivotal importance to appoint reputable and highly-rated insurers who have strong financial status and enough capacity for huge project risk.

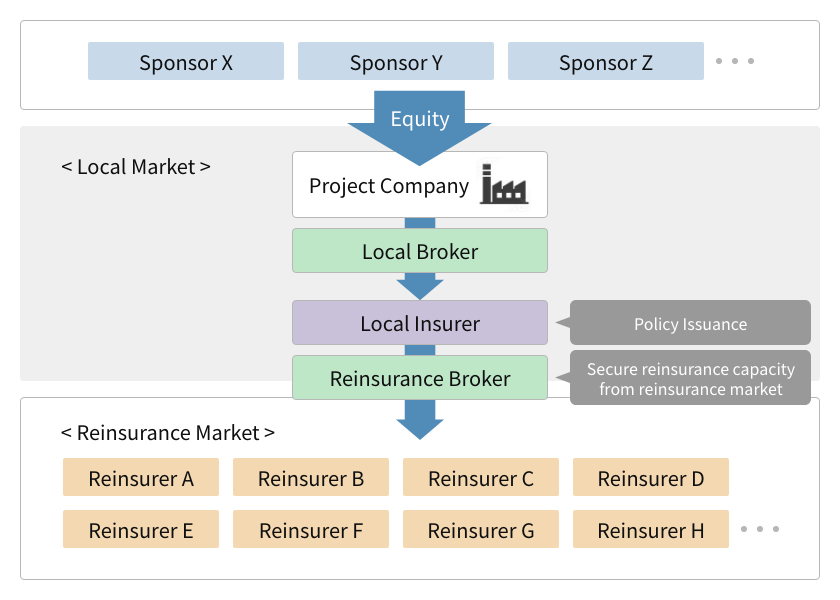

One of the key functions of the insurance broker is to structure an entire insurance scheme. We will introduce a brief overview of structuring the insurance scheme below.

Local Insurance Regulation

In most countries, there is a requirement issued under the insurance law that any property or risk located in the country have to be written by an insurer who has a license in the country. This kind of requirement is legally in force in all but a few countries to protect and foster the country’s insurance market and to prevent the insurance premium being flowed abroad.

Reinsurance

As a matter of fact, reinsurance is usually not restricted by a local regulation such as the one stated above. Therefore, when the financial foundation of a local insurer is fragile, reputable and highly-rated reinsurers in the international market complement the weakness of the local insurer. Most large projects are now substantially supported by the reinsurance market and lenders always give a great deal of attention to the credit rating of reinsurers rather than the local insurer, who usually does not have such rating.

Placement

Structuring this insurance scheme including reinsurance is the insurance broker’s role. The local insurer retains none or just a small percentage of the risk, and almost all portions are ceded to a number of reinsurers. When arranging the insurance, the broker usually starts to negotiate with the reinsurance market which controls insurance terms and insurance premiums, and the appointment of local insurers is of secondary importance.

Illustration