Energy

Placement

Offshore energy exploration and production of hydrocarbons require significant capital expenditure, and thus the risk exposure of an E & P project is also enormous, even for a single consortium member. Accordingly, the insurers of such consortium members have to secure reinsurance capacity before writing the policies. The following is some key knowledge relevant to purchasing offshore energy insurances, concentrated around the capacity issue and the function of (re)insurance brokers.

Insurers and their capacity

The size of the risk under offshore energy insurance by far surpasses the capacity of a single insurer, not to mention that of a fronting insurer in such case when the local insurance regulations require placing the risk with local insurers. Therefore, it is very important to secure a sufficient number of (re)insurers, so as their total capacity can absorb the full required capacity.

Reinsurance

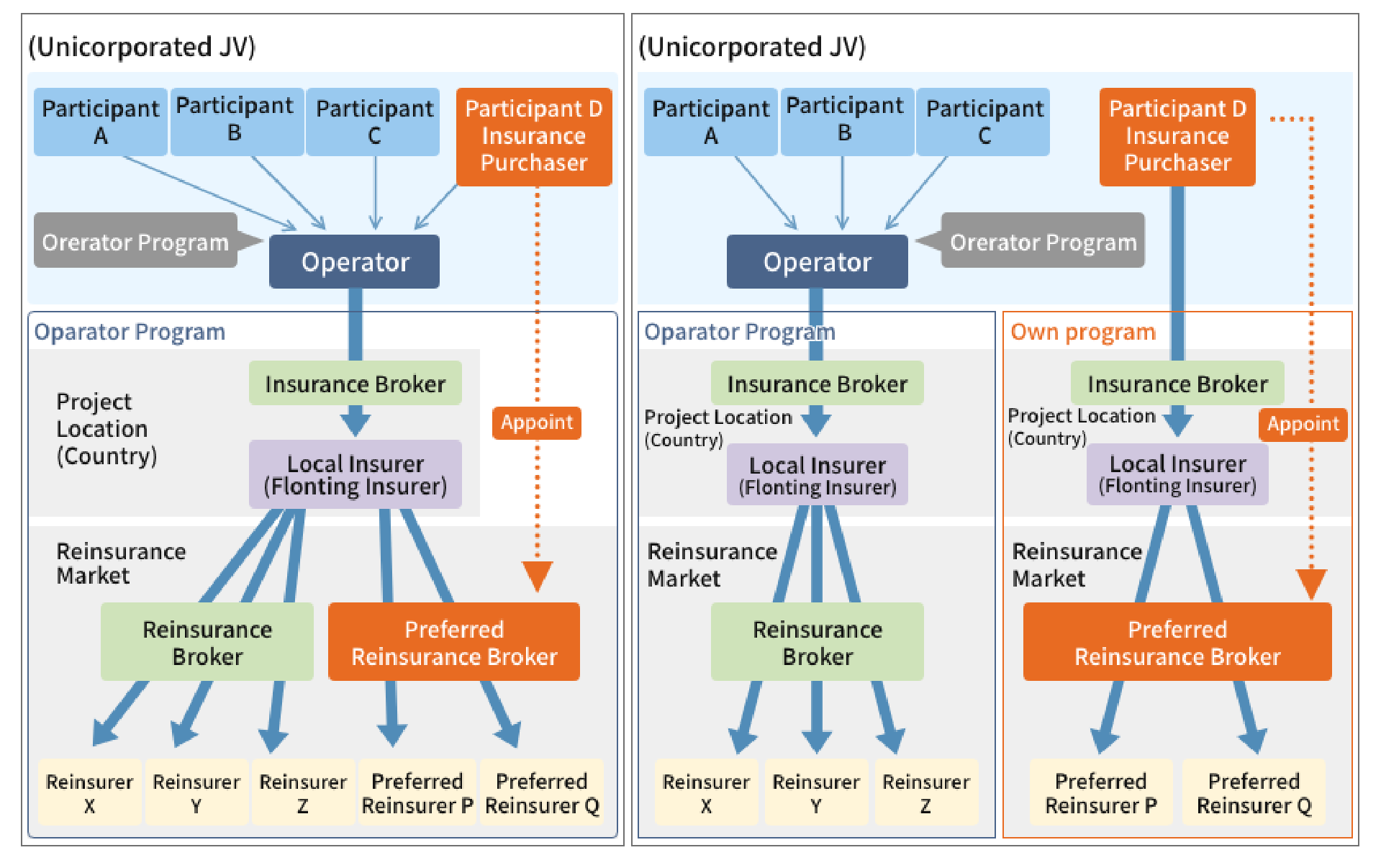

In order to secure the necessary capacity, the insurers arrange reinsurance programs, which are usually beyond the sight of the assured. However, it is very important to understand and have the full picture of such reinsurance arrangements, because the security level of the reinsurers participating in the program greatly affects the soundness and stability of the whole insurance program. Intermediating between an insurer and a reinsurer when an insurer purchases reinsurance is one of the basic functions of the (re)insurance brokers. Whether purchasing an “own policy” or joining the operator program, it is very important to liaise closely with a reliable insurance broker for the risk management of the project.

Own Program

Operator Program

Even when joining the operator program, consortium partners can actually participate in the arrangement of the program by requesting the operator to appoint the preferred broker for the partner's equity share, in the placement of the insurance or reinsurance. Via such arrangement as the foregoing, a partner can have access to the full details of the insurance program.

In the case of purchasing an “own policy” it can be tailor-made to the company's own needs (i.e., insured amounts, deductibles, and coverage) according to the company's own needs and ability to finance risk. It is essential to appoint an experienced broker in arranging customized insurance that is competitive and best suited to the assured's specific requirements.